This article was published on the site of ‘Inkoperscafé’ and translated for international sharing.

In recent years, retail prices have skyrocketed due to extreme hikes in energy costs and challenges in obtaining raw materials. Despite a significant drop in inflation, consumers still pay much more for products or energy than they did a few years ago. Yet, the prices of raw materials, energy, and transport have returned to their levels from before. How is it that retail chains like Action (a popular European discount retail chain) and IKEA can pass on their lower purchasing costs to their customers while many others do not?

In January of this year, the furniture giant IKEA and discount chain Action significantly reduced prices for many products. According to the companies, they were able to do this due to a decrease in transportation, energy, and material costs. Furthermore, IKEA stated it wanted to give something back to the consumer after the price increases of the past few years, hence it cut into its profit margins.

This did not lead to a price war, as other major retail chains did not follow suit. The reasons they provided were varied, ranging from higher container prices, increased labor costs, rising energy prices, small profit margins, and limited prior price hikes, to the uncertain global political situation and fear of a price war.

Rising Raw Material Costs

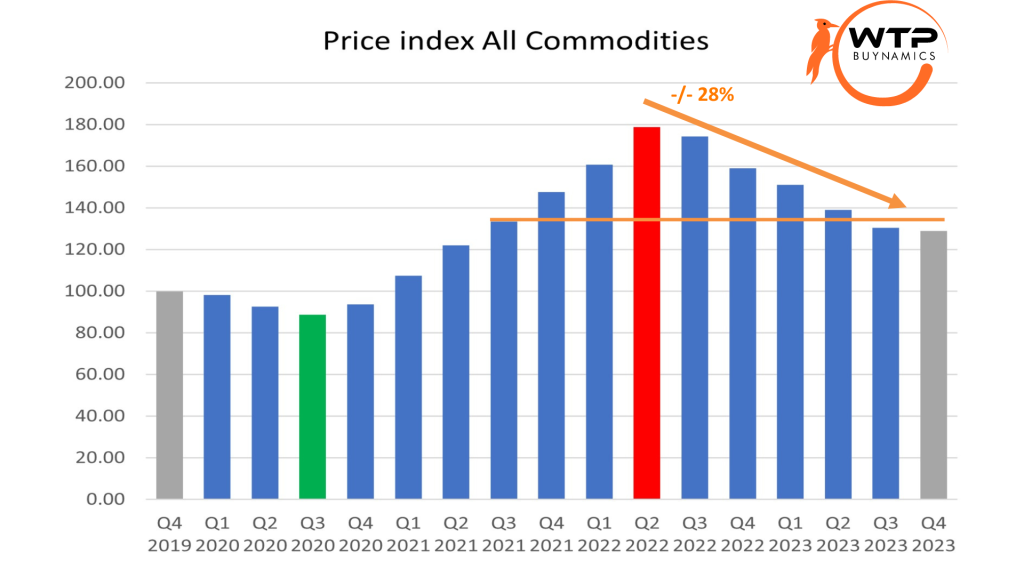

Are costs currently a reason not to lower prices? Buynamics Purchasing Data researched the price development of 3,000 raw materials. “They have now returned to the average price level of 24 months ago,” says Robert Driessen, founder and CEO of Buynamics.

Container and Shipping Costs

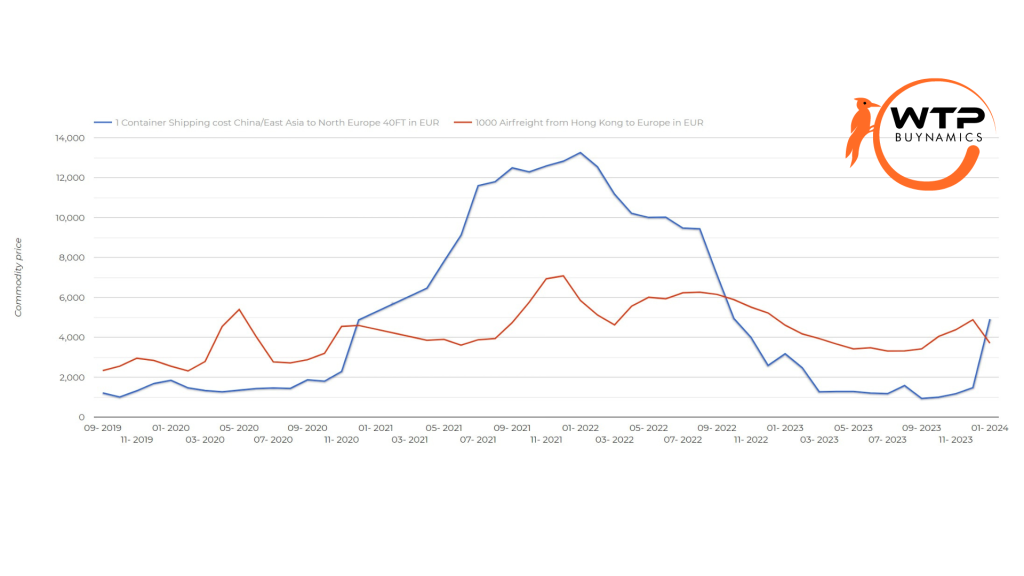

Currently, container prices have doubled compared to the end of 2023 due to Houthi rebels attacking ships in the Red Sea. As a result, many ships on the route to or from Asia are detouring via the Cape of Good Hope. However, container prices were exceptionally low at the end of 2023 after plummeting throughout 2022 and 2023. They are still considerably low compared to rates during the coronavirus pandemic. ING bank (a global financial institution based in the Netherlands) analysts suggest that the impact of higher transport costs due to the Red Sea issues is minimal. Additionally, experts expect container prices to decrease over 2024 due to overcapacity from stagnation in global trade and the introduction of many new container ships. “The Red Sea shootings are thus not a reason for significant and prolonged price increases. It’s a temporary situation. Moreover, not all goods become more expensive because of it,” emphasizes Driessen.

The Impact of Labor Costs

Another reason for high retail prices could be the rise in labor costs in response to high inflation in recent years. For example, in 2023, around 200,000 retail workers received a wage increase of over 7 percent in a new collective agreement. Also, the minimum wage is significantly increasing. However, these wage increases are not disproportionately high and are relatively lower than the inflation of the past one and a half years. In many sectors, there has also been a relatively limited wage increase for years, alongside much faster profit growth. The wage increases followed after the peak of inflation, and since then, inflation has only decreased. “Moreover, it’s important to realize that direct labor costs only represent a relatively low portion of costs within a manufacturing company. On average, this is around 10%,” Driessen notes. Therefore, higher wages are not a reason to keep prices high.

The Role of Energy Costs

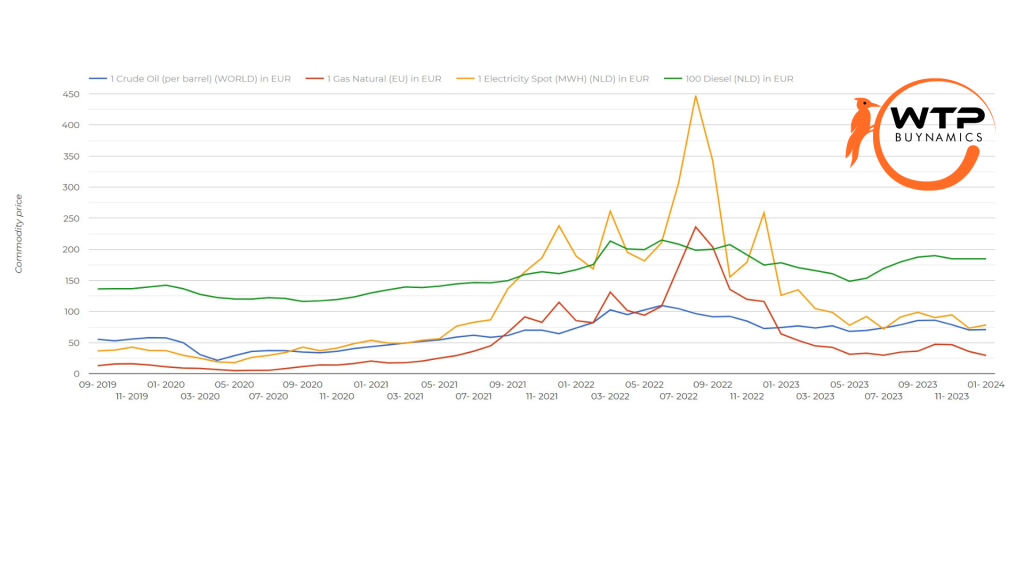

After the extreme peak of gas and electricity prices in September 2022, these have also returned to the price level of the summer of 2021, before the significant increases began. Therefore, energy prices are no longer an excuse for higher retail and product prices.

Margin Management

Most purchasing costs are back to the level before the high inflation of recent years. Thus, selling prices could often be reduced without issues. According to Driessen, companies keep selling prices too high out of profit-oriented motives. “Higher energy costs, raw material prices, container prices, and labor costs are reasons for companies to further increase their prices and thus their profits,” says Driessen. “Manufacturers raise their price, and further down the supply chain, companies often round up these prices significantly. It’s about additional price increases of 50 to 100%. At the beginning of a chain, a price increase might be, for example, 1.2%, and at the end of the chain, the price increase could have escalated to 7.5%.”

This, according to Driessen, relates to companies’ profit margin management. “Cost increases are always bad news due to margin optimization. It’s about maximizing profits and wanting to maintain these profits. It subsequently causes a lot of pain for companies to lower prices. As a rule, it takes five years after the first price increases, based on market turbulence, before prices return to a normal market level.”

Driessen appreciates IKEA and Action for lowering their prices but points out they are exceptions. “These are two very healthy companies. The competition cannot follow them. Undoubtedly, marketing considerations play a role, and they have calculated what was still advantageous for them.” He adds that whether and to what extent prices are adjusted within a particular supply chain largely depends on the power relations within the chain. “As soon as the retailer has the power, often based on large volumes and private labels, it usually accepts lower price increases from suppliers, thus there is room for margin improvement and/or even lower prices. As soon as the power lies with the manufacturer (strong brands), then increases are usually just stacked on top of each other. In the case of Action and IKEA, the former is true.”

Artificially High Retail Prices

That selling prices are kept artificially high is also reflected in various studies. For example, the French bank Société Générale published a study at the beginning of 2023 showing that profits at American companies grew much faster than their revenues. Research from the European Central Bank (ECB) in spring 2023 showed that company profits since 2021 accounted for the majority of price increases in the eurozone. Eurostat, the European statistical office, calculated that price increases by companies have more influence on inflation than higher purchasing costs and labor costs. Moreover, retail expert Michel Kreger told Hart van Nederland in February 2024 that prices had risen much more than necessary. “The margins that chains calculated were ultimately too high,” said Kreger.

A study by the CPB (Netherlands Bureau for Economic Policy Analysis) in April 2023 on the effects of higher energy costs on company profits showed that companies often significantly passed on their increased costs to customers. The selling prices were higher than the cost prices of goods and services from other companies. However, studies in recent years from CBS (Statistics Netherlands) show that not all companies pass on costs to customers. The most recent Economic Survey of the Netherlands from January 2024 by CBS even showed that in retail, nearly 73 percent of entrepreneurs cannot or hardly pass on cost increases to their customers. In the first quarter of 2023, this was less, with nearly 53 percent.

The Complex Path from Cost Reduction to Price Adjustment

A large part of price increases in stores is thus caused by the margin policy and profit maximization of companies in a supply chain. Price increases accumulate within a chain. Suppliers raise their prices due to often temporary cost increases. Many purchasers then pass this on to their customers. These price increases are also not quickly reversed, delaying price reductions. “Companies are looking for reasons to further increase their profits every few years,” says Driessen. “Think of the coronavirus, the tsunami and nuclear disaster in Japan, or the Ukraine war. However, these are only reasons for temporary price increases.”

Driessen argues that it is the task of purchasers to only temporarily accept price increases, not permanently. “They need to work with suppliers to determine when and how prices can be lowered. This applies to the entire supply chain. A lower purchasing price, however, has no (direct) effect on the selling price, as that is determined by marketing and sales. Purchasers only need to meet their targets. So, the purchase price can decrease without this being reflected in the selling price.” Therefore, it’s not due to poor purchasing that prices have spiraled out of control at so many companies in recent years, and why they haven’t lowered these prices for a long time.