Fictional inflation: What is it?

Fictional inflation is a term we came up with when, based on data over the last years, we saw a few disturbing trends occurring. Fictional inflation is the mechanism that occurs especially in times of crisis, where real inflation is overshadowed by fake inflation.

When the (global) market is completely disrupted, there is a massive focus on availability. The result is a large, fictitious (fake) demand that in time does not add up. Far too much is temporarily produced and purchased based on panic demand. The result is a vicious cycle that leads to increasing pressure on availability.

This mechanism enlarges the disruption and drives up prices even further. It is usually caused by a combination of uncertainty and (commercial) opportunity. Salespeople know all too well the impact of margin improvement. So all parties with an interest in price increases reinforce this process.

Greedflation?

In the media and even in our governments the term ‘greedflation’ is a hot topic. Which is more or less in alignment with fictional inflation, because of its timing. Timing is crucial because at a point in time when costs are rising it is tempting for companies to top up their margins or to charge their end users with the cost of a fictional doom scenario. This scenario has a far-reaching effect, one of which is stated in this recent article in The Guardian: Ever higher interest rates won’t solve the problem of greedflation.

Before greedflation was a hot topic, we came up with the term fictional inflation at the end of 2022, because we are buyers and we saw fictional demand driving up cost true data we analyzed. Greedflation is a term used when Sales are accused of using news of inflation to gain more margin at the expense of consumers. As buyers we should use facts, historical and actual data, to pinpoint where we can mitigate costs and that is what this blog post is all about.

Negotiation opportunities

Herein lies a cool challenge (read: an opportunity for mitigating costs) for the buyers. After a previous price increase (based on fictional inflation) it is your job to get prices back to a normal level. You have to prevent that years down the line you’re still paying a high price which was founded on fictional inflation. Besides that, suppliers must be confronted with this mechanism, because it helps the entire buying community in their negotiations when we can prove what will happen in the long run.

Now that we understand what fictional inflation is, let’s explore how it originated and how we can leverage negotiation power.

Times of crises

Over the past four years, businesses have faced various crises such as the COVID-19 pandemic and the Russia-Ukraine conflict, increasing costs. But if we zoom out and consider a broader timeframe, as shown in the table below, we can observe numerous extremes. Could any buyer have been fully prepared for all these challenges?

- 2001: Foot-and-Mouth Disease (Europe)

- 2002: SARS (26 countries)

- 2003: Avian Influenza (semi-global)

- 2008: Financial Crisis (global)

- 2010: Iceland Volcanic Eruption (Northern Hemisphere)

- 2011: Fukushima Nuclear Disaster (Asia)

- 2014: Ebola (West Africa)

- 2015: Brexit (Europe)

- 2018: US-China Trade War (global)

- 2020: COVID-19 (global)

- 2021: Suez Canal Blockage (global)

- 2022: Ukraine Conflict (global)

- 2024: World War 3, Global Cyber Attack…

Source: Nevi trade magazine: Deal!

Simplifying fictional inflation

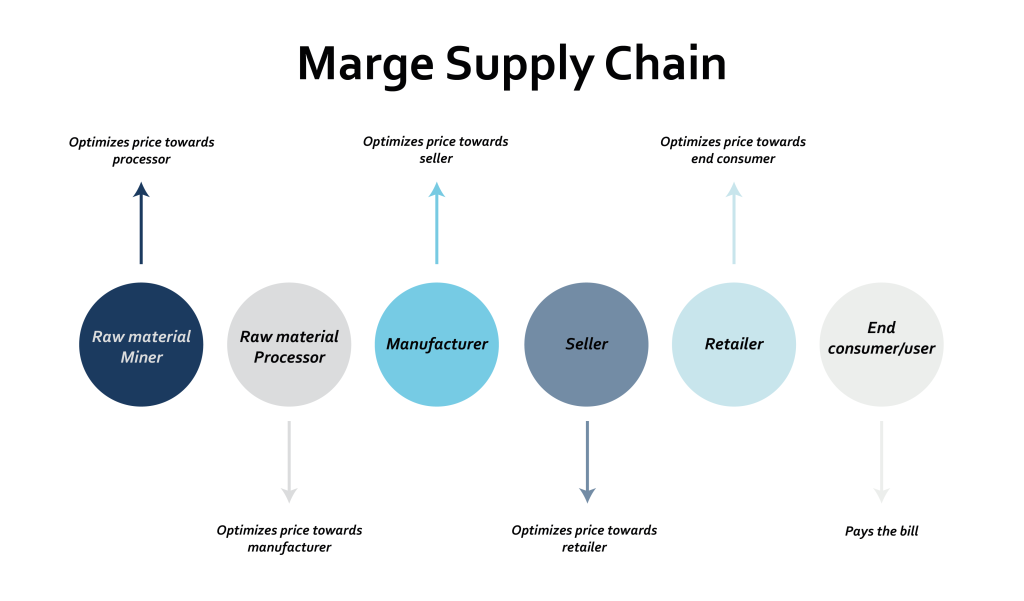

Your supplier is just one link in the chain of compounding price increases. Each link in the traditional supply chain has experienced rising costs and subsequently engaged in margin management, resulting in compounding inflation. Within a traditional supply chain, this happens five times.

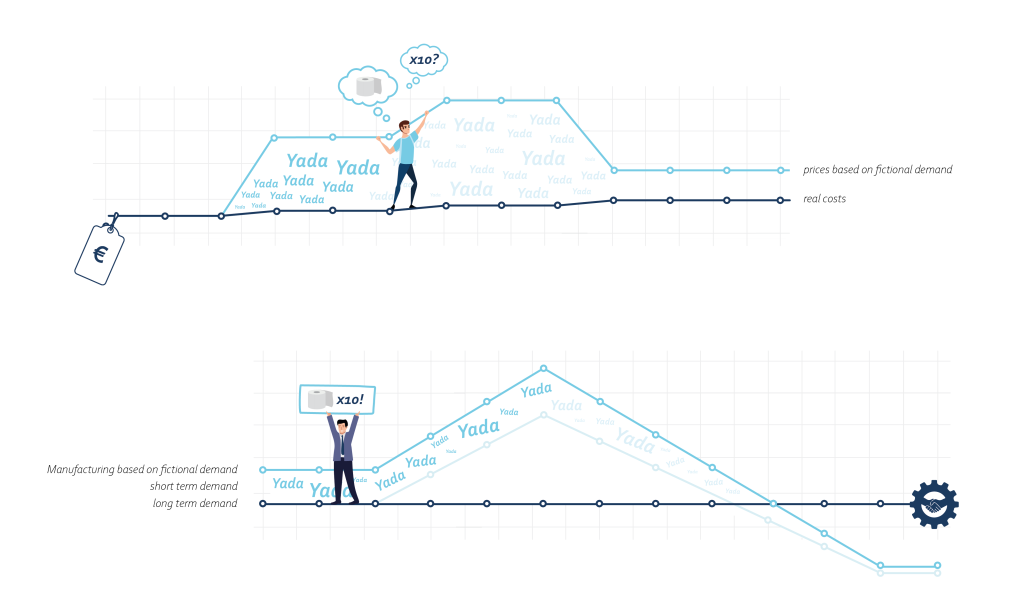

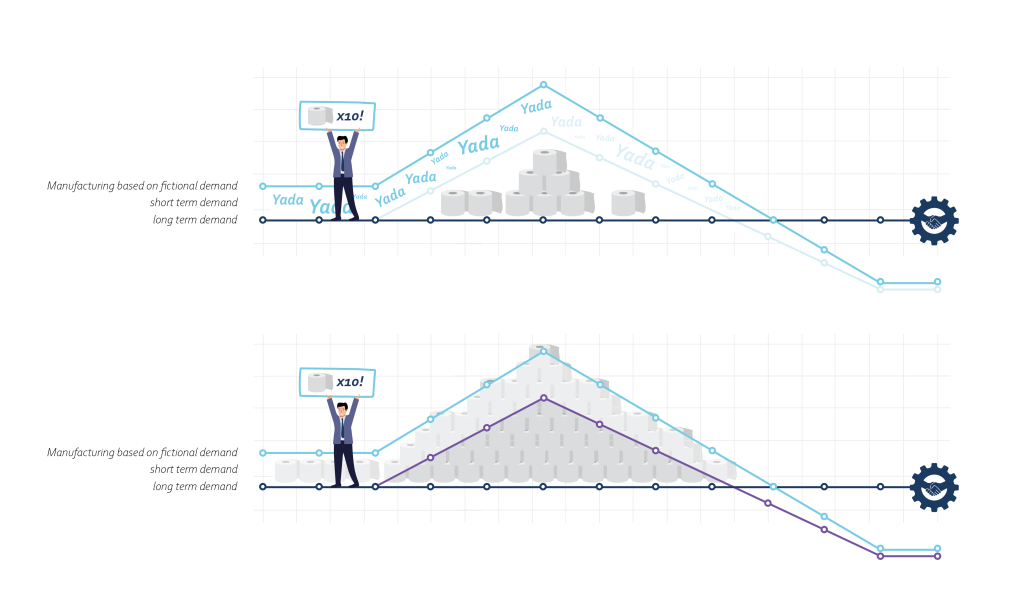

Furthermore, this phenomenon affects all secondary suppliers, including those providing energy and transportation services. During times of crisis and supply chain disruption, the focus shifts to availability, leading to an increase in fictional demand. Panic-driven overproduction intensifies the pressure on availability, creating a vicious cycle. If you translate this into a graph, it looks like this:

This mechanism increases disruption and drives prices even higher. Salespeople, like buyers, know the impact of improving margins. For every salesperson, this is the time to also think about themselves and improve their margin.

Point by point, this boils down to the following:

- “Normal demand” is stable

- “Panic demand” during a crisis rises sharply and then falls again later

- Production rises dramatically in response to panic demand

- “Normal prices” experience a slight rise due to actual inflation.

- Market prices rise enormously due to panic demand

- Market prices rise much faster than inflation and remain high in the long run.

To clarify this theory, here are 3 different examples.

Example 1: “Energy”

Energy prices peaked in 2022, which is undeniable. However, the impact on individuals or businesses largely depends on the contracted agreements. Some individuals and companies purchased energy at previous prices because they had agreed to a long period of price stability with their energy supplier or “hedged” a certain volume. Hence, not everyone is paying the higher price. But almost everyone uses rising energy prices as an argument for their price increase. This increase is then a combination of their own costs (whether or not they have risen) combined with the (higher) energy costs of suppliers. However, in almost all cases, the maximum increase is communicated, which also includes a risk factor for the coming period. More is then paid throughout the supply chain, explaining the exponential impact of rising energy prices.

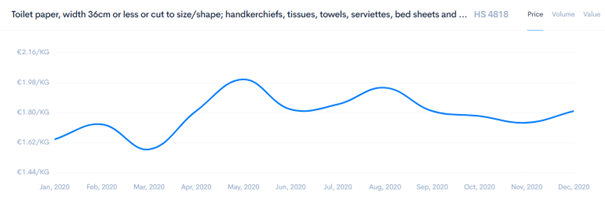

Example 2: “Toilet paper”

Demand in the Western world for toilet paper is stable. At most, it follows population growth but our defecation behavior is not subject to major changes. However, during a crisis, such as the onset of COVID-19 in January 2020, panic-driven hoarding caused a sudden surge in demand for toilet paper. The graph below shows that demand increased dramatically. As a result, the price rose. But in the long run, the population used exactly the same amount of toilet paper as before the crisis. Only the pattern of demand led to a disruption in the supply chain. Prices rose with increasing (apparent) demand and remained at higher levels even after May 2022.

The result: volume increased 40% in one month from 200 million kg to 280 million kg Consequently, the price remained 40% higher 2.5 years later, from 1.64 to 2.29.

Source: Commoditystats

Translate this characterizing example to our earlier graph and it looks like this:

Example 3: “Dishwasher”

This example is based on a personal experience. So let me share a little story. I was renovating my kitchen and, being a buyer, I handled the appliance selection myself. I chose a dishwasher with a provisional delivery time of 6 months, but I continued my search as I didn’t want to wash dishes by hand for several months. I found the same dishwasher on a German website at a slightly higher price but with a 3-month delivery time. Since I could still cancel my initial order, I placed an order for this one as well. Later, another buyer tipped me off about ordering dishwashers directly from a dealer. I found one that was 20% cheaper, although the delivery time was unknown. I placed an order for that one too, and now I’ll wait and see which one gets delivered first.

The result: the manufacturer now anticipates delivering three dishwashers and adjusts their forecast to this fictional demand. They will procure more materials and components to meet the demand for three machines, including safety stock due to increased demand. The entire supply chain thinks it will be a peak year but in reality, I end up buying and paying for only one. This fictional increase in market demand triggers the market mechanism, causing prices for all parts and the dishwasher itself to rise.

Opportunities for purchasers

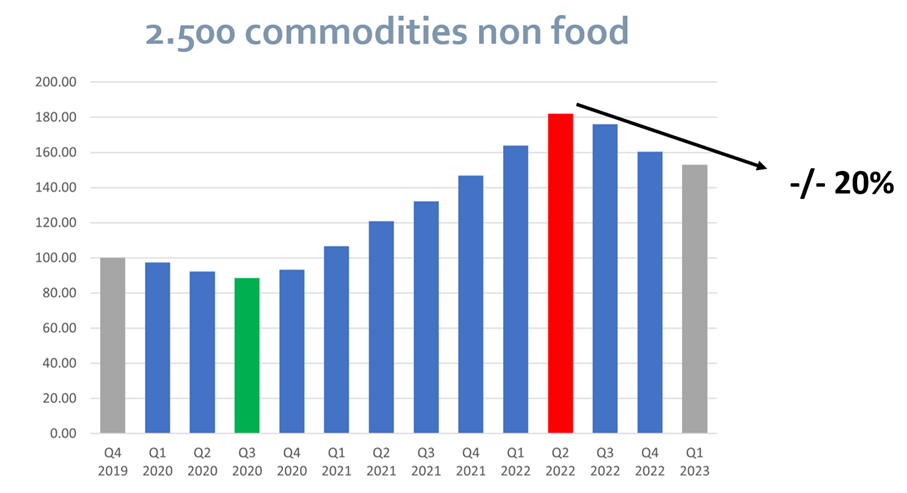

When we analyze the price of 2500 commodities (non food) over the last 3 years, we see the following development:

Source: WTP

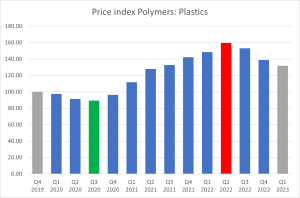

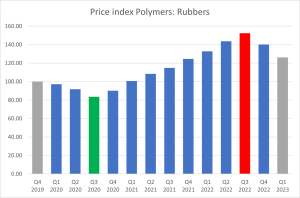

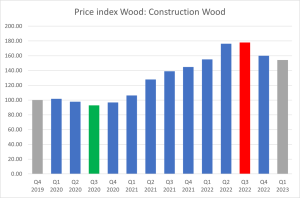

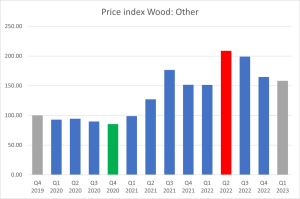

Buyers who have paid price increases between Q3 2020 and Q2 2022 are now entitled to reductions.

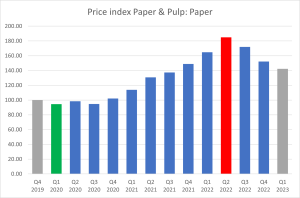

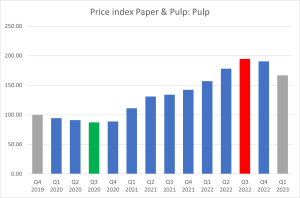

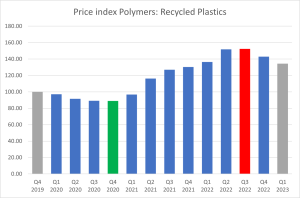

Some more graphs to show you some more opportunities:

In general, three effective strategies can help counter price increases, especially in the context of fictional inflation. And these are where the huge opportunities lie. You can apply these strategies starting today to quickly bring down your price points:

- Comprehensive Data Analysis:

- Analyze historical pricing data for commodities over a specific period

- Leverage price increases paid during a certain period to negotiate reductions in the current scenario

- Supplier Relationship Management:

- Foster strong relationships with suppliers based on trust and transparency

- Encourage open communication and collaboration to find mutually beneficial solutions (your supplier can go to their supplier with data and so the whole supply chain benefits, resulting in fairer margins and a better price for end customers).

- Alternative Sourcing and Diversification:

- Explore the benefits of exploring alternative suppliers and diversifying supply sources. This mitigates the risk associated with cost escalations and supply chain disruptions.

- When sustainability is of importance, tip 3 helps to realize these KPIs.

Concluding: as a buyer, you are both responsible for the acceptance of price increases as well as the rectification of them. So off you go! Use fictional inflation to your advantage.

However, there is a slight disadvantage in this game. Sales teams invest significantly more in price data and data management than procurement does. Therefore, the game is won by those who have access to the best data. When you possess knowledge about the components of your products, understand the impactful cost drivers, and track their development, you will never overpay.

By effectively managing fictional inflation and employing the strategies mentioned, you can navigate the complex landscape of pricing, negotiations, and supply chain disruptions with confidence and success. Start implementing these strategies today to secure cost savings and strengthen your position as a savvy buyer.